The State of Pension Systems: A Crumbling Foundation

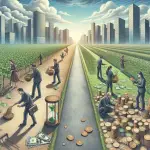

The pension systems across America are teetering on the edge of disaster – an issue that is conveniently ignored much too often by our policy makers. As fiscal conservatives, it is the time to shine a glaring spotlight on this issue, as it dramatically affects our economy and personal finances.

Understanding the Crisis

To paint a picture of the severity, several cities, and even some states, are facing challenges to meet their pension obligations. The promises made to public employees, albeit noble, have turned out to be fiscally irresponsible and, at times, even untenable. As the future unfolds, these unfunded liabilities threaten to implode our state and local finances, impacting our economy disproportionately.

Fundamental Principles

As conservatives, we follow some fundamental principles while addressing economic challenges:

- Limitation of Government: We firmly believe in the free market mechanisms and limited government intervention. The bloated bureaucracy and inefficiencies of the government can be a hindrance to thriving economic activity.

- Fiscal Responsibility: Making promises that are financially unrealistic and creating unfunded liabilities runs counter to our belief in fiscal responsibility. Policies should be feasible and shouldn’t saddle future generations with unsustainable debt.

A Conservative Approach to Pension Reform

The solution to this crisis, as seen from the fiscal conservative lens, isn’t complicated. It requires straight talk, realistic planning, and robust execution.

Moving Towards Defined Contribution Plans

A viable conservative solution involves transitioning from defined benefit plans to defined contribution plans. Not only does this approach place a limit on the financial liability of the government, but it also allows individuals the freedom to manage their retirement funds.

Transparent and Realistic Accounting

The accounting strategies for public pensions are too often reminiscent of smoke and mirrors. It is a matter of urgency that these strategies are replaced with conservative, realistic assumptions to calculate liabilities. We need transparency and honesty in our numbers.

Implementing Later Retirement Ages

With life expectancy on the rise, it only makes sense to adjust retirement ages upwards. This approach reduces the total payout period and makes the pension system more sustainable long term.

The High Stakes

If no action is taken, we stand at the brink of a financial precipice. The pension crisis could result in significant tax increases or severe cuts in public services. The burden of this fiscal recklessness will fall on the shoulders of citizens – your friends, family, and you. The time for responsible reform is now.