Government Spending: Prioritizing Needs Over Wants

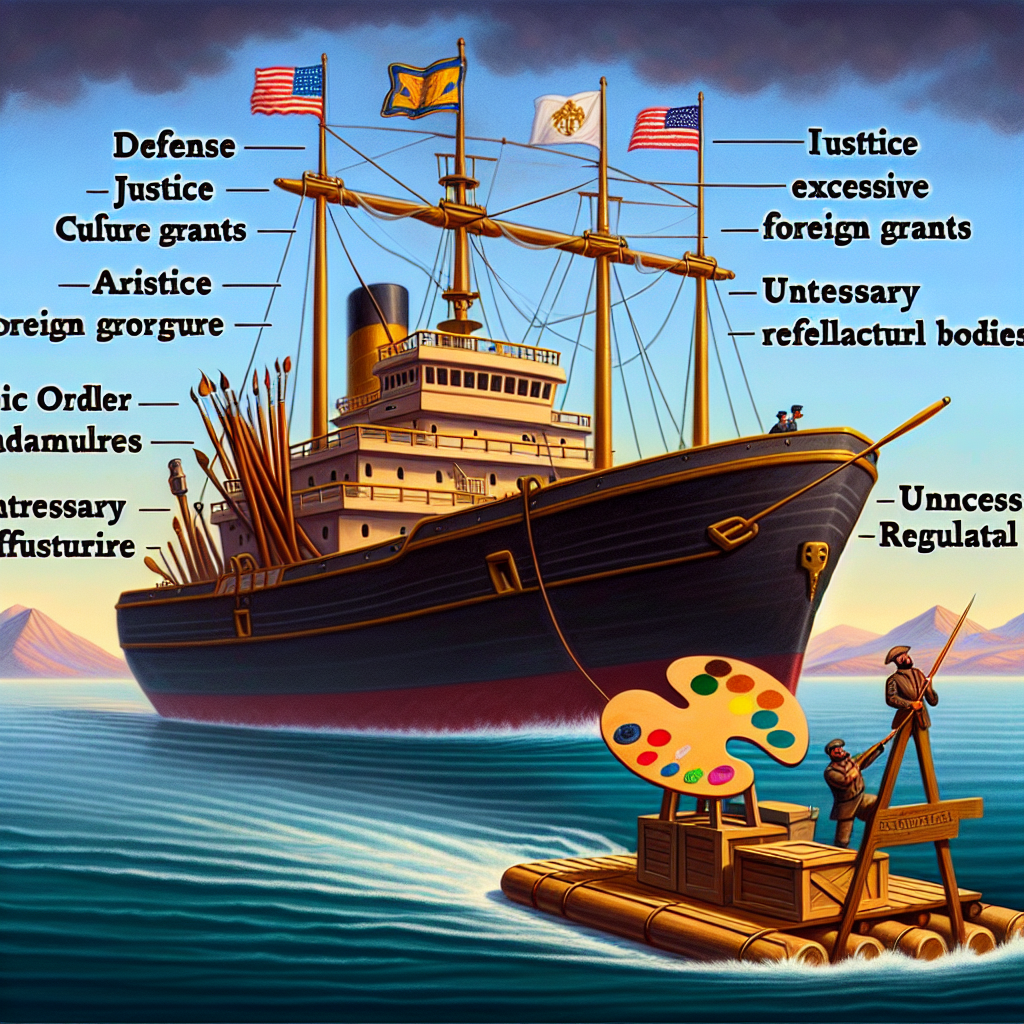

America is facing a fiscal crisis of epic proportions – one directly linked to government overreach and overspending. The hard-earned taxpayer dollars are being drained on a multitude of non-essential services, projects, and programs that the government has deemed ‘necessary.’ It’s time we overloaded the ship of state with some commonsense.

Essential vs Non-Essential: Where to Draw the Line?

From a fiscal conservative perspective, government spending should strictly prioritize essential services and responsibilities. The foremost priorities should be defense, justice, and public order, followed by basic infrastructure and essential public services.

- Defense: The fundamental duty of any government is to protect its people. This encompasses national security, border control, and maintaining a robust defense force.

- Justice and Public Order: Governments must ensure law and order are upheld, and citizens have access to justice. This implies funding for courts, legal aid, policing, and penal systems.

- Infrastructure and Essential Public Services: This includes everything from highways and bridges to water and electricity. It also means funding for public health initiatives that benefit all citizens.

Conversely, non-essential services vary widely and often fall into the category of government spending that does more to uphold political interests than fulfill fundamental government duties. Examples might include arts and culture grants, unnecessary regulatory bodies, and excessive foreign aid.

Real Economic Impact: The Dangers of Fiscal Overreach

Understanding the difference between essential and non-essential spending is crucial because the nation’s economic health hinges on it. The resources for government spending ultimately come from productive sectors of the economy. Therefore, excessive government spending hampers economic growth, as these resources could otherwise be used for productive investment or saved for future spending by private citizens.

If unchecked, this fiscal overreach could lead to several harmful effects:

- Rising National Debt: When the government chronically spends more than it collects in tax revenues, the national debt grows. This increased debt could restrict future economic growth and potentially lead to crushing taxes for future generations.

- High Taxes: To finance bloated government budgets, taxes have to remain high. High taxes disincentivize economic activity and burden households and businesses.

- Dampened Economic Freedom: More government control and greater government spending tend to crowd out private enterprises, limiting economic freedom and innovation.

Choosing Fiscal Prudence: A Way Forward

As fiscal conservatives, it’s time we brought these issues to the forefront. It’s time we reinstated the vision of limited government that our forefathers crafted. It’s time we stood for strong economic freedom that spurs entrepreneurial spirit and leads to growth and prosperity for all.

We can no longer afford to indulge in fiscal imprudence where ‘wants’ are prioritized over ‘needs.’ As a nation, we have to make hard choices to ensure our economy’s vitality now and secure a prosperous future for coming generations.